Contents:

HAL is a defence public sector undertaking and was established in October 1964. It also engages with the ISRO to contribute to the space programmes of the country. HAL’s primary consumers are the Indian Defence Forces comprising of the Indian Air Force, Indian Army, Indian Navy along with the Indian Coast Guard. The government’s push to source defence equipment from the home country provides a tailwind for further growth. To decide what’s best for you, think about how much risk you are willing to tolerate and how much liquidity you require.

- An equity crowdfunding platform is a website that allows everyday investors to contribute money to new projects or companies looking to raise cash to expand.

- Visit our sister website that specializes in real estate investing to learn how.

- CDsinvolve paying a lump sum that remains untouched for a period of time as it gains interest.

- A bond can be one of the safest investments, and they become even safer when used as part of a fund.

As futures are best for short-term investments, you’ll be best limiting your stakes. At the end of the fixed term , you’ll then receive your total investment back as one lump sum. You should limit your stakes when investing in oil, as prices are very volatile. It might be best to treat oil as a short-term investment so that you can make gains when the market is up. Don’t forget, you can also make money when the prices go down if you decide to ‘Go Short’.Oil often goes up or down in value by double-digit levels every year.

Let’s Talk Money » target= »_blank » rel= »noopener » > Let’s Talk Money

That mid-career—especially in tech-centric specialties—could weigh on unemployment figures. Companies seeking to whittle payroll may pursue leaner staffing protocols, leaving plenty of talent on the sidelines to appease shareholders. Not every observer was so sanguine, however, and it didn’t take long for runaway inflation to become a major headache for markets and regular Americans. Chainlink’s token, which trades under the symbol LINK, facilitates transactions on the network. It has a market cap of $3.77 billion as of April 3, placing it within the 20 largest cryptocurrencies. Ethereum is the name of both a blockchain platform and the platform’s native cryptocurrency.

12 Cheap Utility Stocks to Buy According to Analysts – Yahoo Finance

12 Cheap Utility Stocks to Buy According to Analysts.

Posted: Sun, 09 Apr 2023 14:52:49 GMT [source]

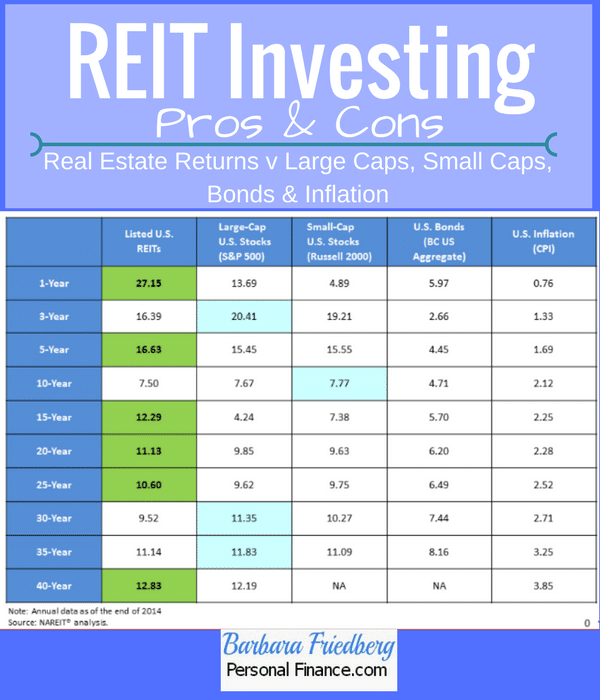

While stocks have officially emerged from the bear market in the second half of 2022, stock markets remain down by double-digits. Bonds are basically structured loans made to a large organization. Real estate is often thought of as a « safe » investment because prices tend to trend upward over the years.

Stock market index funds

They will charge a higher fee to compensate for the additional cost of doing so. Finance studies consistently show that active management does not produce a high enough return premium to cover this fee. Trade stocks & options on the advanced yet low-cost Freedom24 platform that arms retail investors with the tools to trade like professionals. Municipal bonds, or “munis,” are issued by cities, counties, and other state government entities in order to finance public works projects like building roads or schools. Contrary to corporate or federal government bonds, interest paid on municipal bonds are often tax-free . Value stocks also anticipate changing market valuations of companies.

For example, the UK funds could underperform if the country’s economy struggles. Investing in funds can be a great way to build long-term wealth. Here, Edward Sheldon highlights nine top funds he likes for 2022. Determine your financial needs and goals – only invest what you can afford to lose.

But I was expecting my investment to grow to at least Rs. 18,000 in 3 years. The minimum investment in ULIP varies from one financial entity to another. Generally, a minimum of INR 1,500 is required as premium payment per month. You can buy SGBs from banks, post offices, stock brokerage companies both online and offline. You can open this account by depositing INR 500.To keep the account active, you have to deposit at least INR 1,000 in a financial year.No upper limit on how much you can invest per year.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Brian Beers is the managing editor for the Wealth team at Bankrate.

Mutual funds are another type of investment that can be very lucrative if you know how to use them properly. These are pools of money that are invested in a variety of different securities, such as stocks or bonds. By buying shares in a mutual fund, you’re essentially investing in the fund itself rather than just the specific securities it owns. This can lead to higher returns over time if the fund does well overall.

The more money you can invest, the more likely it’s going to be worthwhile to investigate higher-risk, higher-return investments. Are you saving for a house down payment in three years or are you looking to use your money in retirement? Time horizon determines what kinds of investments are more appropriate. The investment ideas listed above are some of the most popular ways in which savers and investors can grow their money over time.

Financial Knowledge

Starting with UK-focused products, one of my top picks is Royal London Sustainable Leaders. This fund has an ethical focus and I see it as a great ‘core holding’. At the end of October, top holdings includedPrudential, Experian, and Astrazeneca.

If you’re looking to back a low-risk company that pays regular dividends, then there are no limits to the amount you choose to invest. When you receive your dividends, you should also consider re-investing them back into additional stocks. Bond returns will depend on whether you are buying government or corporate bonds, and how risky the underlying institution is. On average, you can expect to make between 1-5% per year in interest payments. This allows you to invest in lots of companies, rather than just one or two. Traditional real estate investing involves buying a property and selling it later for a profit, or owning property and collecting rent as a form of fixed income.

Here’s all you should know about life insurance.

This fund, which is managed by Terry Smith, is one of the most popular equity funds in the UK, and it’s not hard to see why. Since its launch in late 2010, it has delivered a return of about 18% per year, which is phenomenal. At the end of November, top holdings includedFuture, Prudential, and Next Fifteen. Zooming in on performance, the long-term returns here have been excellent. Over the five years to the end of November, the fund delivered a return of around 106%.

In this way, compounding amplifies the when am i eligible to receive a dividend and maximizes the earning potential of your money. One is starting early and the other is keep on reinvesting over a long time period, say 10 years to 20 years. For example, an individual fresh at a plush job would not mind losing Rs. 25,000 on equity investment. Whereas the same amount is sufficient for an old person to meet his monthly expenses and the amount needs to be preserved.

ETFs share several perks with index funds, including their low costs and easy portfolio diversification. Plus, many ETFs come with greater tax efficiency than handpicking individual securities. And most retirement and brokerage accounts permit ETF trading, making them readily accessible to investors of all stripes. Growth stock funds remove the need to evaluate and select individual growth stocks. Instead the fund is actively managed by expert managers who choose a diversified set of growth stocks to invest your money.

- Stash101 is not an investment adviser and is distinct from Stash RIA. Nothing here is considered investment advice.

- Stash does not represent in any manner that the circumstances described herein will result in any particular outcome.

- The best investments in 2023 may help you win the battle against inflation and increase your real wealth.

- The mutual fund returns generated minus the expense ratio will be the net return earned by the investor.

- When considering your time horizon, also think about how quickly your investment can be converted into cash.

- We have such confidence in our accurate and useful content that we let outside experts inspect our work.

Since 2020 saw a crash immediately followed by a flow of liquidity in the system, all the https://1investing.in/ rallied leading to a market rise by ~80% from its lows in March. The rally has been broad-based and all the stocks have participated whether they had or did not have sales growth. Currently, the expectations are of rising interest rates regime which might limit the multiple expansions. Thus, in 2022, the stocks without earnings growth might see some correction.

Tesla has continued to outperform expectations for years now, following up its extraordinary 700% gain in 2020 with a 31% YTD gain in 2021 (as of Dec. 16). The company has transformed itself into a profit engine, after years of losing money, and analysts expect the company to earn $8.17 per share in 2022. On top of that, Tesla will be opening two new gigafactories in 2022, in Texas and Germany, and this should increase its production greatly. With a market cap now exceeding $1 trillion, Tesla is on a seemingly unstoppable roll.

You can expect 12-14% returns from stocks & mutual funds after the right analysis. Over the years, investment in gold has given consistent returns of around 10% beating inflation and providing diversification. A better way to invest in Gold is through a Gold mutual fund, Gold ETF and Gold bonds. The liquid mutual fund invests your money in highly liquid short term instruments like the bank’s CD, T-bills and commercial papers with a maturity period of less than 91 days. Stock investments carry higher risks and therefore capable of generating very high returns.