Contents:

Feb producer prices has reduced the demand for gold as an inflation hedge. April gold on Monday closed up +49.30 (+2.64%), and May silver closed up +1.417 (+6.91%). Precious metals Monday rallied sharply for a second session, with gold climbing to a 5-week high and silver jumping to a 2-week high.

The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs. This means that this pair is suited as a new addition to your portfolio as trading bullish markets is always a lot easier. The New Zealand Trade Balance for August was reported at -NZ$2,144M monthly and at -NZ$2,940M 12-month year-to-date. Forex traders can compare this to the New Zealand Trade Balance for July, reported at -NZ$397M monthly and -NZ$1,100M 12-month year-to-date. Exports for August were reported at NZ$4.35B and Imports at NZ$6.49B.

- This widget shows the latest week’s Commitment of Traders open interest.

- Concerns about contagion risk from the collapse of Silicon Valley Bank and the closing of Signature Bank of New York have sparked safe-haven buying of precious metals.

- We provide both analysis from leading experts for experienced traders and articles on trading conditions for beginners.

- As a result, the 10-year T-note yield today sank to a 5-week of 3.380%.

- Storylines Follow Bloomberg reporters as they uncover some of the biggest financial crimes of the modern era.

Conversely, Eurozone Jan industrial production rose +0.7% m/m, stronger than expectations of +0.3% m/m. Also, France’s Feb CPI was revised upward by +0.1 to a record high 7.3% y/y. Also, the slump in stocks today has boosted the liquidity demand for the dollar. Hello Everyone, I hope you’ll Appreciate our Price action Analysis !

days New Zealand Dollar / Singapore Dollar currency rate prediction

The U.S. Mar NAHB housing market index unexpectedly rose +2 to a 6-month high of 44, stronger than expectations of a decline to 40. The history of Singapore is thought to date back to the 3rd century AD. For many centuries, it was part of various Asian states, being a trading port at the crossroads of sea routes. In the 19th century, Singapore was introduced into the British Empire.

A bearish factor for gold is the continued liquidation of long gold positions in ETFs after gold holdings fell to a new 2-3/4 year low last Friday. The dollar index on Monday fell by -0.86% and posted a 3-1/2 week low. The ongoing turmoil in the U.S. banking sector is undercutting the dollar. Also, a sharp decline in T-note yields Monday weighed on the dollar as the turmoil in the banking sector reduced expectations of tighter Fed policy. In addition, a rebound in equity markets after early losses reduced the liquidity demand for the dollar.

График NZDSGD

By switching between different timeframes, you can monitor exchange rate trends and dynamics by minutes, hours, days, weeks, and months. Use this information to forecast market changes and to make informed trading decisions. To make an analysis, one should consider New Zealand’s and Singapore’s economic stats and those of the US, too, because the pair is valued against the US dollar. The main export product is sheep wool, so the NZDSGD rate depends directly on global sheep wool prices.

A thumbnail of a daily chart is provided, with a link to open and customize a full-sized chart. Your browser of choice has not been tested for use with Barchart.com. If you have issues, please download one of the browsers listed here. Learn more about our full range of powerful features including the best charts on the web.

Market Data

In the NZ commodity sector, we can single out gold and wood. A well-developed international tourism sector makes the country’s economy depend on the features of the region’s climate and weather forecasts. The main trade partners are China, Australia, and the USA. It’s mostly used by experienced traders who know how to make forecasts for the pair’s rate. The difference between New Zealand’s and Singapore’s economies is the reason why it’s so hard to analyze the pair.

Turmoil at Credit Suisse Group AG added to heightened concerns about the global financial sector and sparked safe-haven buying today of precious metals. Also, the plunge in global bond yields is bullish for metals. A stronger dollar today is limiting the upside in metals prices.

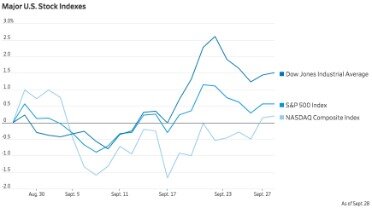

China’s Shanghai Composite stock index closed up +0.55%, and Japan’s Nikkei Stock Index closed up +0.03%. U.S. Feb PPI final demand fell -0.1% m/m and rose +4.6% y/y, weaker than expectations of +0.3% m/m and +5.4% y/y with the +4.6% y/y gain the slowest year-on-year increase in nearly two years. This is the New Zealand Dollar to Singapore Dollar exchange rate history summary page for 2016. The pair breakout from the support now back to retest the support level.

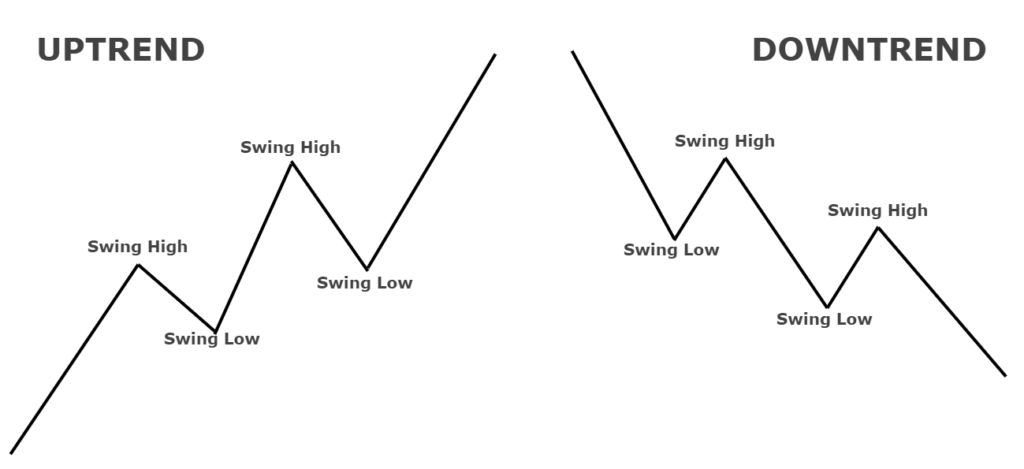

There’s a potential Gartley pattern developing, It’s last leg complete at AOI and this probable market structure would add… Japan’s economic news Monday was bearish for the yen after the Q1 BSI large manufacturing business conditions fell -6.9 to a 2-1/2 year low of -10.5. The downtrend may be expected to continue, while market is trading below resistance level 1,0691, which will be followed by reaching support level 1,0524 – 1,0481. The downtrend may be expected to continue, while market is trading below resistance level 1,2143, which will be followed by reaching support level 1,2029 and 1,1924. We partner with the most popular currency and cryptocurrency data providers worldwide to bring you the most recent quotes for all major cryptocurrencies. The cryptocurrency values displayed on our site are aggregated from millions of data points and pass through proprietary algorithms in order to deliver timely and accurate prices to our users.

NZD/SGD

The main currency of the country from 1904 to 1939 was the Straits dollar, issued by the Council of Commissioners for Monetary Circulation. In 1939, the Malay dollar replaced the previous currency. Euro Currency futures may have finally found it’s footing, and the market rejected new lows and may have sparked short covering. Live educational sessions using site features to explore today’s markets.

The company provides services for online FX trading and is recognized as one of the world’s leading brokers. We have won the trust of more than 7,000,000 retail traders, who have already appreciated our reliability and focus on innovations. Holidays with InstaForex are not only pleasant but also useful. We offer a one-stop portal, numerous forums, and corporate blogs, where traders can exchange experiences and become successfully integrated into the Forex community. This section contains the most lucrative offers from InstaForex.

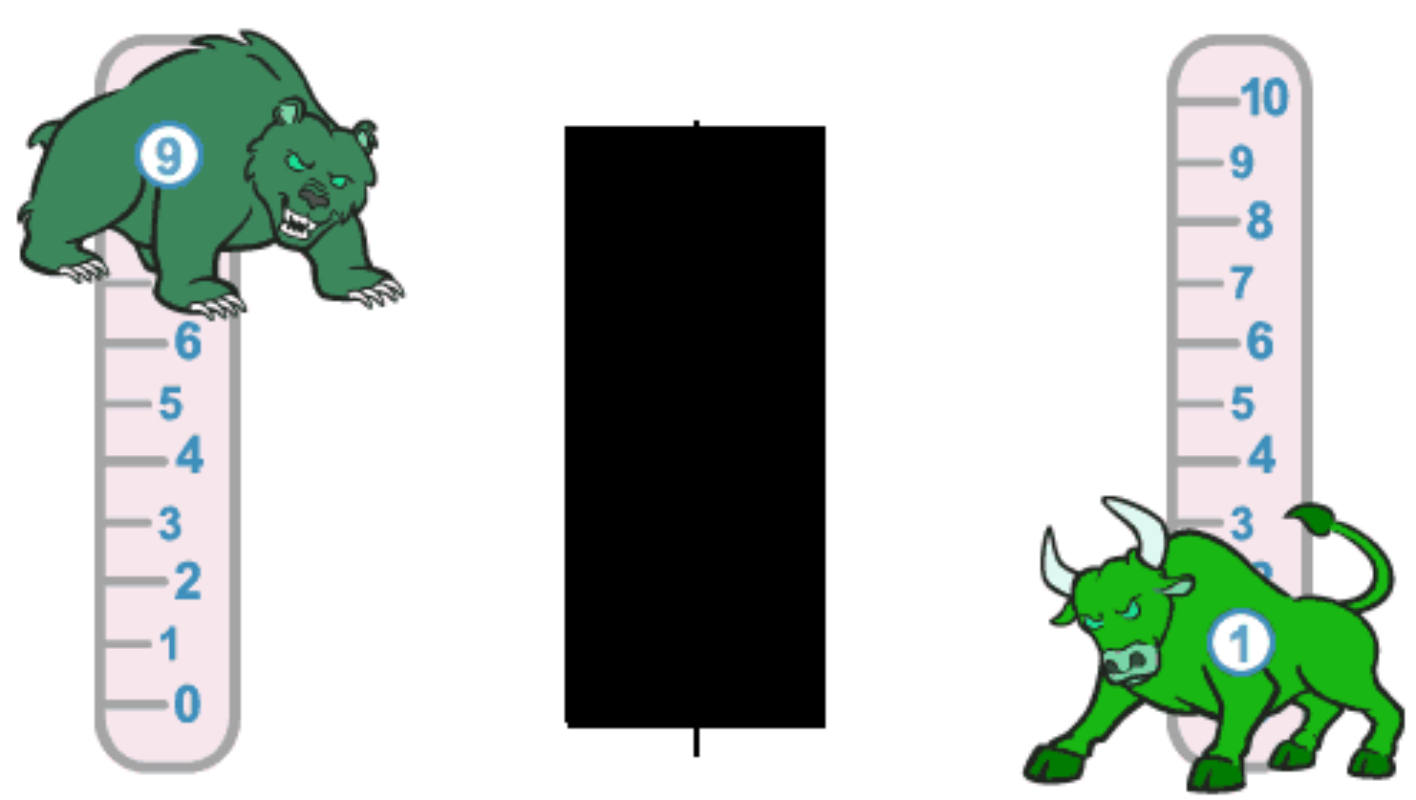

The two currencies do not correlate much, so the rate can move unpredictably. However, with a thorough approach to analysis, traders can make profits trading the how are currency exchange rates determined in the short term. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods.

On the date of publication, Rich Asplund did not have positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. The U.S. Mar Empire manufacturing survey general business conditions fell to -18.8 to -24.6, weaker than expectations of -7.9.

Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable. On the negative side, the German Feb wholesale price index eased to +8.9% y/y from +10.6% y/y in Jan, the slowest pace of increase in 1-3/4 years.

As of 2023 March 17, Friday current rate of NZD/SGD is 0.837 and our data indicates that the currency rate has been in a downtrend for the past 1 year . The main economic sectors are services, commerce, and industry. The country exports electronic and household equipment and shipbuilding equipment, too. A skillful monetary policy and low levels of corruption allow Singapore to maintain stable prices. Besides, the Singapore economy is attractive to investors. Exchange-rates.org is a currency and cryptocurrency converter tool and data provider used by millions of people across the globe every month.

Storylines Follow Bloomberg reporters as they uncover some of the biggest financial crimes of the modern era. This documentary-style series follows investigative journalists as they uncover the truth. The Barchart Technical Opinion rating is a 56% Sell with a Weakest short term outlook on maintaining the current direction. The is trying to firm after getting rejected at downchannel resistance and sliding roughly 100 pips. Regardless of any further profittaking in the next day or so, odds are…

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. News https://day-trading.info/ Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.